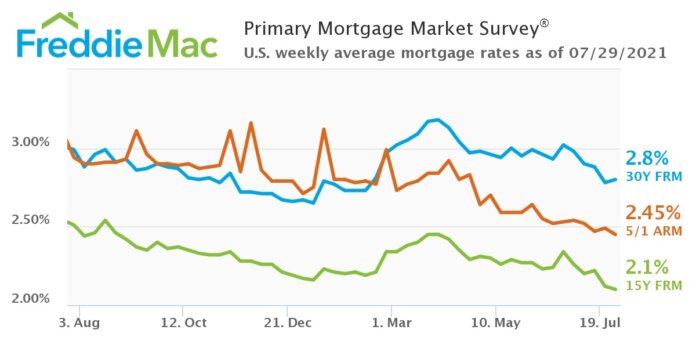

The results of Freddie Mac’s Primary Mortgage Market Survey show that the 30-year fixed-rate mortgage (FRM) averaged 2.8 percent the week ending July 29.

“As the economy works to get back to its pre-pandemic self, and the fight against COVID-19 variants unfolds, owners and buyers continue to benefit from some of the lowest mortgage rates of all-time,” says Sam Khater, chief economist at Freddie Mac. “Largely due to the current environment, the 30-year fixed-rate remains below three percent for the fifth consecutive week while the 15-year fixed-rate hits another record low.”

The 30-year fixed-rate mortgage averaged 2.8 percent with an average 0.7 point, up from last week, when it averaged 2.78 percent. A year ago at this time, the 30-year FRM averaged 2.99 percent.

The 15-year fixed-rate mortgage averaged 2.1 percent with an average 0.7 point, down from last week (2.12 percent). A year ago, the 15-year FRM averaged 2.51 percent.

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.45 percent with an average 0.3 point, down from last week, when it averaged 2.49 percent. Last year, the five-year ARM averaged 2.94 percent.

Read the full report here.