Housing starts slowed in May, as mortgage interest rates increased and home sales began cooling.

Starts of residential homes were at a seasonally adjusted annual rate of 1.549 million – a decrease of 14.4% compared with April and down 3.5% compared with May 2021, according to the U.S. Census Bureau and U.S. Department of Housing and Urban Development.

Starts of detached, single‐family homes were at a rate of 1.051 million, a decrease of 9.2% compared with April.

Starts of multifamily homes (five units or more per building) were at an annual rate of 469,000, a decrease of 26.8% compared with the previous month.

Building permits also tumbled. They were at an annual rate of 1.695 million, a decrease of 7.0% compared with April.

Permits for single-family homes were at a rate 1.048 million, a decrease of 5.5% compared with April.

Permits of multi-family dwellings were at a rate of 592,000 in May, down 10% compared with the previous month.

Housing completions, however, tell another story, as production increased through most of last year and the first quarter of this year. Housing completions in May were at a seasonally adjusted annual rate of 1.465 million, an increase of 9.1% compared with April, and an increase of 9.3% compared with May 2021.

“Single-family home building is slowing as the impacts of higher interest rates reduce housing affordability,” says Jerry Konter, chairman of the National Association of Home Builders (NAHB) and a home builder and developer from Savannah, Ga., in a statement. “Moreover, construction costs continue to rise, with residential construction materials up 19 percent from a year ago. As the market weakens due to cyclical factors, the long-term housing deficit will persist and continue to frustrate prospective renters and home buyers.”

“In further signs that the housing market is weakening, single-family permits are down 2.5 percent on a year-to-date basis and home builder confidence has declined for the last six months,” adds Robert Dietz, chief economist for NAHB. “Due to the acceleration in construction activity in recent quarters, housing completions are rising. Single-family completions were up 8.5 percent in May 2022 compared to May 2021 as inventories rise.”

Odeta Kushi, deputy chief economist for First American, says the decline in housing starts “mirrors the decline in homebuilder confidence.”

“Homebuilder confidence dipped lower in May for the sixth month in a row,” Kushi says. “Homebuilding is a leading economic and housing indicator, and the decline in confidence suggests that housing is cooling.”

“Builders face supply chain disruptions, rising input costs, and concerns that declining affordability is pricing out buyers,” Kushi says. “The new-home market is particularly sensitive to rising rates, and builders want to ensure that if they build it, someone will buy it. Builders are responding to the decline in affordability and cooling demand by building less, but a slowdown in construction is concerning because the U.S. continues to face a housing shortage. We need more homes, not less.”

One major factor holding back production is a lack of skilled labor.

“Skilled labor shortages continues to hamper builders, making it difficult to build,” Kushi says. “In April, hires per job opening, a measure of how readily employers can turn openings into new employees, dipped to a series low. No hammers at work, no homes.

“Yet, it’s not from lack of trying,” she adds. “The annual growth in average hourly earnings of production and non-supervisory employees in construction picked up in May, increasing 6.3 percent year over year. The best way to attract and retain workers is to pay more.”

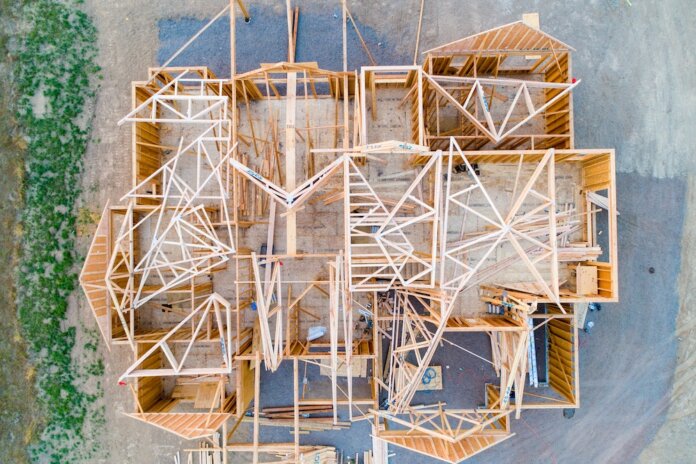

Photo: Avel Chuklanov