The U.S. mortgage industry has earned an average profit of $4,202 per loan on its way to record volume and a record $4.4 trillion in new loans originated in 2020 – and the perfect storm of low interest rates and high home values has kept the gold rush going in 2021. According to J.D. Power’s 2021 U.S. Primary Mortgage Origination Satisfaction Study, mortgage originators have struggled to manage surging refinancing volume and efforts to streamline new issuance with one-size-fits-all digital workflows have eroded customer satisfaction at critical points along the way.

“Mortgage originators have been working for years to create an effective and efficient origination process, primarily through digitization of the process and implementation of self-help tools, but the massive surge in volume has exposed some serious weaknesses in that approach,” observes Jim Houston, managing director of consumer lending and automotive finance intelligence at J.D. Power.

“It’s not enough to provide consumers with electronic applications and digitized tools to streamline and expedite activities up to and including loan closing,” adds Houston. “Today’s mortgage customers expect personalized, highly customizable experiences that include the right mix of technology and personal interactions based on their unique needs and wants.”

Overall customer satisfaction falls across most segments. With primary mortgage originators, overall customer satisfaction has dropped five points (on a 1,000-point scale) this year, driven largely by declines in satisfaction with the refinancing process. Both banks and non-banks have seen declines in scores in all factors.

Digital self-service combined with live personal service key to retention of younger customers. More than three-fourths (76%) of Generation Y and Z1 mortgage customers who use both live personal service and digital self-service channels during the application and approval process say they “definitely will” consider their lender for their next refinance. That rate falls more than 10 percentage points when only one of these two channels is used.

Application and approval experience still requires some level of human interaction. Among Gen Y and Z mortgage customers, the perceived timeline from application start to approval is shortest when live personal service and digital self-service are combined (12.7 days on average). When traditional/text communication methods (e.g., e-mail, mail, text) are added to the mix, the perceived timeline increases to an average of 21.5 days.

Omnichannel optimization is needed. Nearly one-third (29%) of mortgage customers indicate using all three interaction channels – live personal service, digital self-service, and traditional (mail or email) or texting – during their loan origination. This results in lower satisfaction and perception of lengthier timelines than when the optimal combinations of interaction are used. The industry challenge is not to go all digital or all live personal service, but to tailor the right communication to the right customer at the right time.

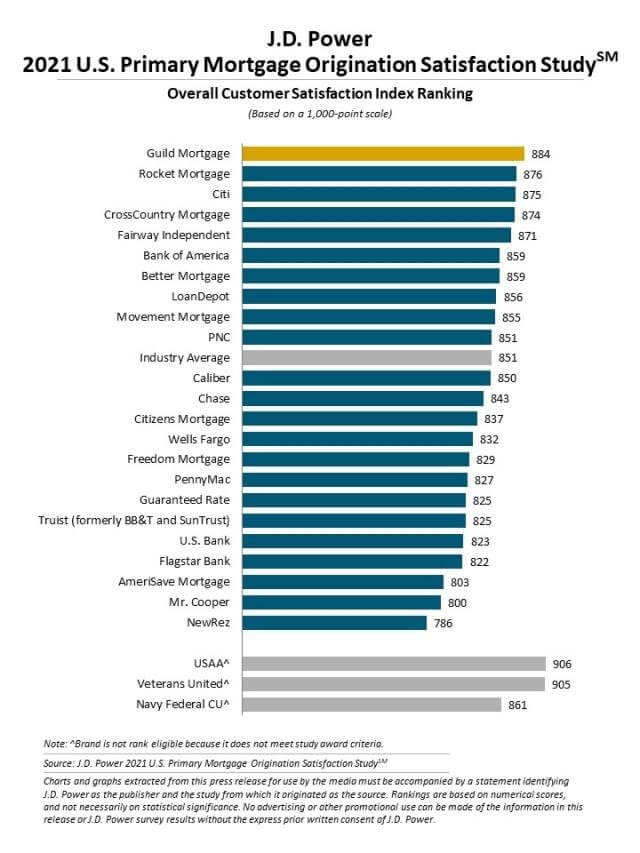

Guild Mortgage ranks highest in mortgage origination satisfaction, with a score of 884. Rocket Mortgage (876) ranks second and Citi (875) ranks third.

The 2021 U.S. Primary Mortgage Origination Satisfaction Study measures overall customer satisfaction based on performance in four factors (in alphabetical order): application/approval process, communication, loan closing and loan offering. The study was fielded in June-September 2021 and is based on responses from 5,414 customers who originated a new mortgage or refinanced within the past 12 months.