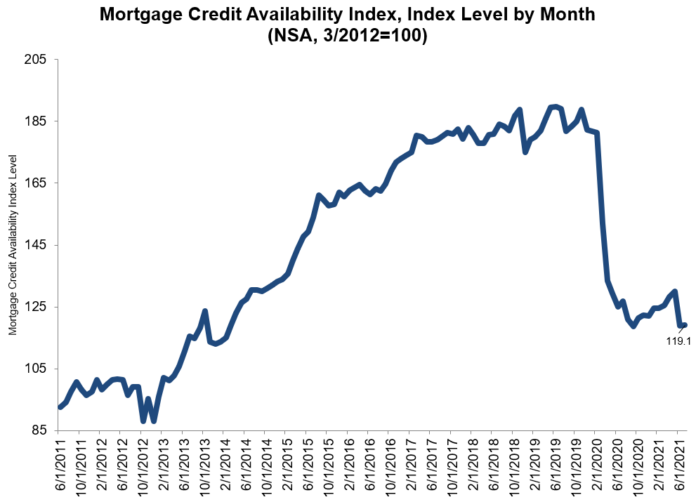

The Mortgage Bankers Association‘s Mortgage Credit Availability Index (MCAI) shows that mortgage credit availability increased in July. The MBA’s report analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool.

The MCAI rose by 0.3% to 119.1 in July. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012.

The Conventional MCAI increased 0.8%, while the Government MCAI was unchanged. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 3.8%, and the Conforming MCAI fell by 3.2%.

“Credit availability slightly increased in July, driven by an increase in jumbo loan programs,” says Joel Kan, MBA’s associate vice president of economic and industry forecasting.

“The overall gain was despite another month of pullbacks in high-LTV refinance programs due to GSE policy changes,” he adds. “The elimination of more high-LTV refinance loans drove most of the 3 percent drop in the conforming index, but that was somewhat offset by lenders adding new refinance loan programs to help qualified, lower-income GSE borrowers. The bounce back in jumbo credit availability followed a sharp drop in June, as some investors renewed their interest in jumbo ARM loans for cash-out refinances and investment homes.”