Mortgage Delinquency Rate Increased in September

The U.S. mortgage delinquency rate increased to 3.48% in September, up from 3.34% in August, according to ICE Mortgage Technology’s latest First Look report.

About...

Ardley’s Platform Now Lets Users Qualify Borrowers Based on Lender-Specified Pricing Adjustments

Ardley, offering technology that parses mortgage servicers’ entire portfolios and identifies viable new origination opportunities in seconds, has launched Forecast, a new feature of...

MCT Adds Customized Spec Durations to MCTlive!

Mortgage Capital Trading says it has improved the functionality of its mortgage hedging software with customized spec durations.

Mortgage lenders using MCT’s capital markets platform...

Share of Mortgage Loans in Forbearance Increased in September

The share of mortgage loans in forbearance increased to 0.34% as of September 30, as loan performance in government products weakened, according to the...

Flagstar Bank Announces Workforce Reduction as Merger with New York Community Bancorp Continues

Mortgage lender Flagstar Bank has been undergoing significant restructuring since its acquisition by New York Community Bancorp in 2022.

Recently, the bank announced a workforce...

Freddie Mac Auctions 57 Deeply Delinquent Mortgage Loans

Freddie Mac recently auctioned 57 deeply delinquent non-performing residential first lien loans (NPLs) with a balance of approximately $13.9 million from its mortgage-related investments...

ATTOM: Foreclosure Filings Decreased During the Third Quarter

A total of 87,108 U.S. properties saw foreclosure filings — default notices, scheduled auctions or bank repossessions — during the third quarter, a decrease...

Fannie Mae Announces Winning Bidder on Pool of Non-Performing Mortgage Loans

VWH Capital Management, a minority and women-owned business, is the winning bidder on a pool of non-performing mortgage loans recently auctioned by Fannie Mae.

This...

MCT Adds the LoanDynamics Model to its MSR Valuation Software

Mortgage Capital Trading has integrated LoanDynamics Model (LDM) from Andrew Davidson & Co. (AD&Co) into its mortgage servicing rights (MSR) valuation software.

LDM is a...

MSR Portfolio With $292 Million in UPB Being Sold Through MIAC Analytics

MIAC Analytics is handling the sale of a $292.91 million Fannie Mae, Freddie Mac, and Ginnie Mae mortgage servicing rights portfolio with $292.91 million...

Average Monthly Housing Payment Has Spiked 20 Percent Since 2020

The average monthly housing payment hit an all-time high in August, due mainly to rising insurance costs, which have been increasing at three times...

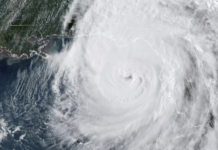

Total Losses from Hurricane Helene to Run Between $30 Billion and $47 Billion

Total flood and wind losses from Hurricane Helene are forecast to run between $30.5 billion and $47.5 billion, according to CoreLogic.

This estimate includes wind...

Rocket Mortgage, Annaly Capital Management Enter MSR Subservicing Agreement

Rocket Mortgage and Annaly Capital Management have entered into a subservicing agreement under which Rocket will handle all servicing and recapture activities for a...

CV3 Financial Services Using The Mortgage Office Platform for Loan Servicing

CV3 Financial Services, a private money lending firm, is using the loan servicing component of The Mortgage Office's platform.

As one of the largest private...

Mortgage Delinquencies Fell in August But Remain Up Compared to Last Year

The U.S. mortgage delinquency rate fell to 3.34% in August, dropping 0.9% compared with July but up 5.1% compared with August 2023, according to...

Fay Servicing Taps Josh Balson as SVP of Data Science

Josh Balson has joined mortgage servicer Fay Servicing as senior vice president of data science.

Balson has more than 15 years of experience in analytics...

FHFA Report Shows Mortgage Performance Holding Strong Overall in Q2

Fannie Mae and Freddie Mac completed 46,378 foreclosure prevention actions during the second quarter, raising the total number of homeowners who have been helped...

Share of Mortgages in Forbearance Increased in August as Labor Market Cooled

The share of mortgages in forbearance increased to 0.31% in August, up from 0.27% in July, according to the Mortgage Bankers Association’s (MBA) monthly...

Mortgage Defect Rate Rises in Q1 After Five Straight Quarters of Decline

The rate of defects in mortgage loans post-closing increased 3.27% to 1.58% in the first quarter, ending five quarters of decline, according to ACES’...

U.S. Foreclosure Activity Decreased in August

There were a total of 30,227 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in August, down 5.3%...