Qualia, a digital real estate closing platform, has released a new mortgage lender edition of Qualia Connect to its platform. This comprehensive suite of features provides lenders with complete control over how they collaborate securely with any title, settlement or escrow partner. Connect now integrates directly into the mortgage lender’s loan origination system (LOS) to enable more efficient, predictable and transparent closing experiences for lenders and their borrowers.

Qualia Connect’s integration between the LOS and the nationwide settlement ecosystem allows lenders to automate and standardize the way they work with any title company in the country. By doing so, lenders get unprecedented visibility to stay ahead of costly delays and errors. Lending teams can also ensure that they maintain control of the borrower experience from order opening through post closing. This is consistent no matter what transaction type, closing location, or closing parties they work with.

“Collaboration between everyone in the closing process remains very manual, inefficient and unpredictable today,” says Nate Baker, CEO and co-founder of Qualia. “We are building products that go beyond just digitizing old processes. Products like Connect work alongside the LOS to reengineer how teams work together in a way that fundamentally transforms how homes are bought and sold.”

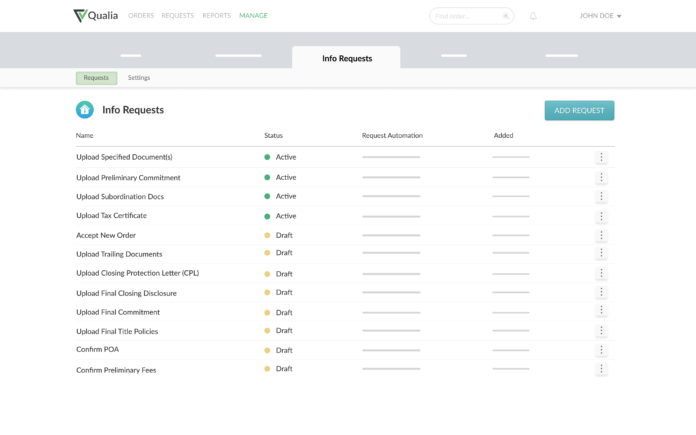

With Qualia Connect’s deep LOS integrations and configurable automation engine, mortgage teams can leverage milestone-based or data-driven automation triggers to send title orders, request information, exchange documents and provide progress updates. All information and documents received in return from the title company flow directly into the lender’s LOS – data auto-populates in the loan file and documents are uploaded to the appropriate folder. Rekeying information, “chasing down title,” managing multiple portals and digging through emails are no longer a requisite part of working with settlement providers. This integration also keeps sensitive information out of email, protecting employees and borrowers from malicious phishing attacks.

In addition, Connect includes new reporting features that provide lenders with visibility into their closing process across their entire loan pipeline for every title, settlement and escrow partner. Lenders can monitor average turnaround times and fulfillment rates across all title providers, and track the status of each transaction in real time to ensure on-time closings and receive early warning signals for loans falling behind. This transparency between the LOS and the title system of record enables lenders to stay in sync with all of their title companies on both aggregate and per-file levels.

“We have already used Qualia to share information with our title partners, but this new functionality in Connect is making a dramatically positive impact across our entire operation,” comments Andrew McElroy, senior vice president at American Federal Mortgage. “It’s such a game-changing process to just look at our reports in Qualia and see that we already have 90 percent or more of the information we need already loaded in there without us needing to take any manual action.”