BLOG VIEW: Shifting borrower employment trends could mean incremental work for mortgage lenders when they are looking to find efficiencies.

This year, mortgage lenders have contended with fluctuating markets, rising interest rates, regulatory pressures, and competition. Volatility in the market and a changing workforce have made a risky landscape even more challenging. Consumers are increasingly changing where and how they work – with many diverting away from staying with one employer for long tenures. The shift was perhaps triggered by the coronavirus pandemic and the resulting move to remote work, the demand for more flexibility, or new job opportunities in new markets. Whatever the reason, the way people work has meant that mortgage lenders are seeing a rise in applications from borrowers with more complex employment and income profiles which can slow down the approval and underwriting process.

For many financial institutions, taking a mortgage loan from application to closing can take weeks and sometimes months. One bottleneck may include employment verification as the prospective loan advances from stage to stage. Lenders take various approaches to verify employment. They may gather and use data from multiple, often disconnected sources. This might include traditional and alternative sources like bank transaction data, consumer-permissioned data, and consumer-provided documents (ex., pay stubs, W-2s). They may also try a combination of verification vendors to get the answers they need—extending an already timely process. Unfortunately, these employment verification methods negatively impact the borrower experience and waste time and money.

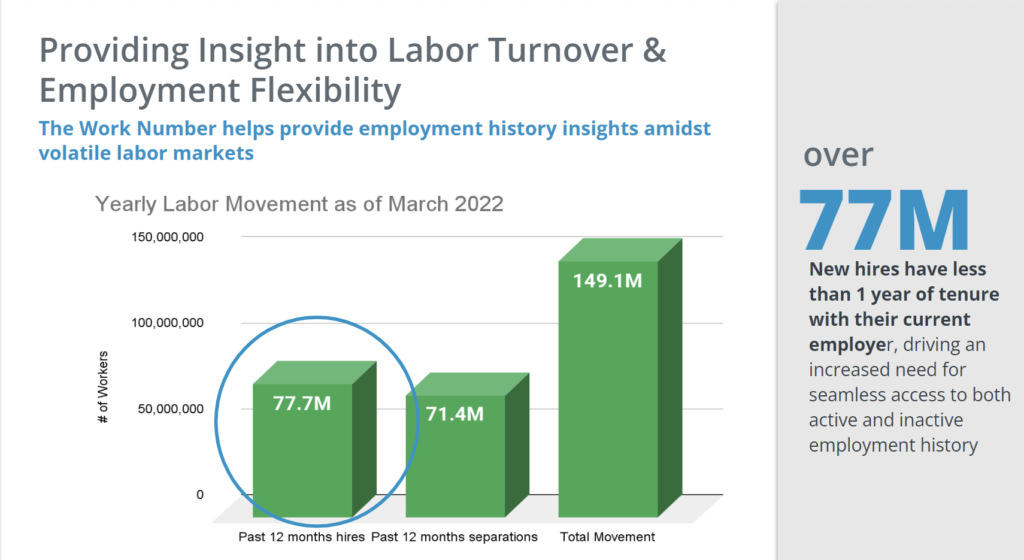

For conventional loans, the government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, generally recommend 1-2 years of employment and income history for loan qualification. However, today’s dynamic workforce makes an expanded employment history more critical than ever before. Having an automated solution in place that enables lenders to request a borrower’s complete employment history, including current and prior employment data, helps provide insight to lenders for a more informed, expanded view of a consumer’s potential ability to pay. Considering seventy-seven million new hires have less than one year of tenure with their current employer, there is an increased need for instant access to current and prior employment records.

Fifty-five percent of mortgage applicants have had more than one job in the last 36 months* requiring verification of employment and income from multiple employers to provide the required income history. Equifax analysts suspect this is due to the job changes that are being seen across various industries.

About Mortgage VOE and Mortgage VOI

Among many different income scenarios, commission-based individuals, those who have had employment disruptions, or those who are applying with real-estate income or assets often require a deeper look into debt-to-income (DTI) and income stability. This requires lenders to review income that may sit outside of calendar/tax years to more quickly identify income trends. These trends may suggest income or earnings potential that better indicate continuity and ability to pay.

As mortgage lenders evaluate or evolve their tech stack to future-proof operations, mitigate risk, and streamline mortgage originations, they may need to reassess their current verification process. In addition, leveraging the industry-leading centralized commercial repository of current and prior employment data can enable agility, speed, and flexibility to keep pace with today’s lending landscape.

Ashley Wood is vice president of mortgage verification services at Equifax.