BLOG VIEW: Can a mortgage-backed security chain (MBSChain) combined with MBS crypto currency (MBSCoin) transform the MBS market for the better?

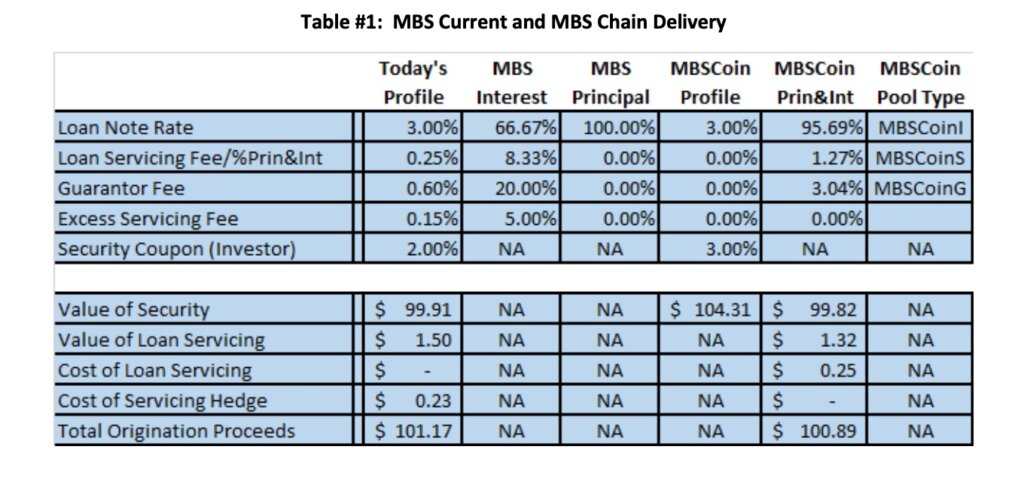

Absolutely. MBSChain is the MBS version of blockchain, while MBSCoin is MBS’s digital currency. The table below shows the current MBSChain delivery profile for securities, loan servicing, and guarantors and their differing values. Readers will recognize the profile as a FNMA/FHLMC delivery – but with slight modification, a GNMA or private-label security sale is possible.

Note: Blockchain and digital currency definitions appear at the end of this article.

Note: This article uses MBSCoin and sells monthly “security pass thru” certificates paying the loan servicer and guarantor with both principal and interest. We could have kept the current structure of paying the servicer and guarantor with interest only by splitting MBSCoin into MBSInterestCoin and MBSPrincipal Coin.

Each month, a new master MBSCoin security pool is formed, backed by single-issuer or multi-issuer loan originations. The first security is akin to a Genesis Block, which is assigned the first personalized public security key for identification. From this master MBSCoin pool, three sub pools are formed: an MBSCoinI pool for investors, an MBSCoinS pool for loan servicers, and an MBSCoinG pool for the guarantor.

One might ask, why is all the complication/division necessary? MBSCoin coordinates the funding of loan servicing assets, issuers/servicers obligations, guarantor’s insurance and oversight, implicit/explicit government backing, and exchange for U.S. dollars forming the backbone for vibrant primary and secondary securities markets.

Note: MBSCoin may be assigned at the loan level, creating the Genesis Block at the most granular level.

How Does the Process Work for Market Participants?

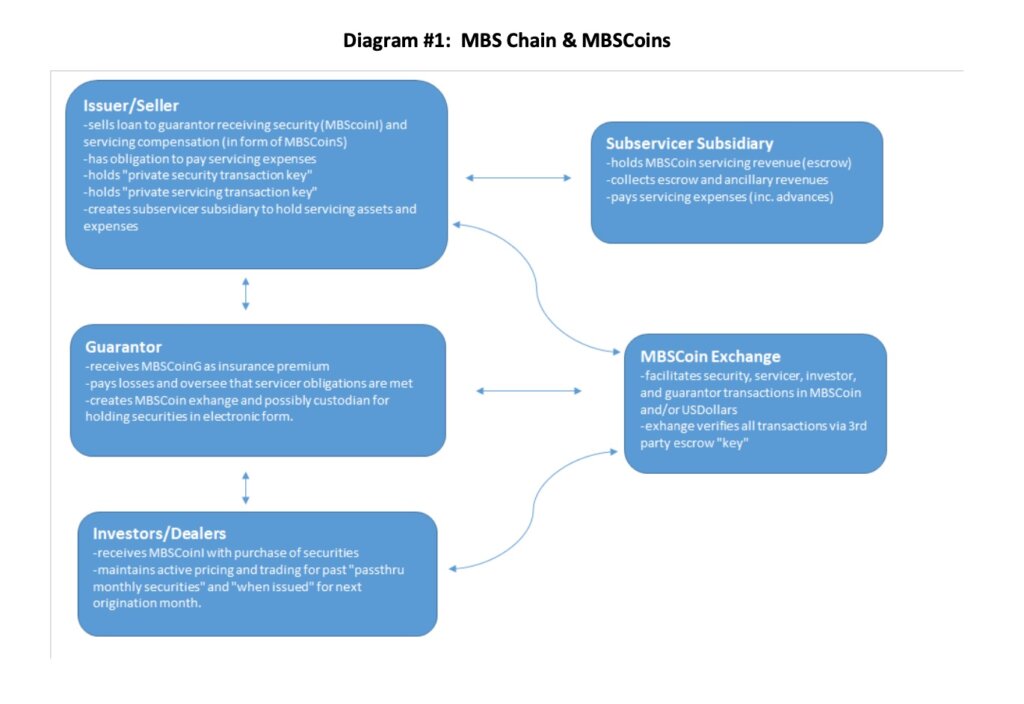

The issuer is assigned a public digital key for each security, ensuring MBS participant identification; dealers provide a price for each monthly historical security pass-thru plus a TBA security price for when issued pools. Once the issuer receives the MBSCoinI security, a private security key is assigned to initiate security transactions. In our example, the issuer MBSCoinI represents a 95.69% pro-rata interest in the “master” MBSCoin.

The issuer/servicer gets paid via MBSCoinS (meaning they receive capital (in the form of MBSCoinS) up front for lifetime servicing fees) and receives a private digital key to activate the monetization/exchange of loan servicing fees to cover servicing expenses. The secondary market for loan servicing rights would use MBSCoinS. Each issuer/seller of securities would have a loan subservicing subsidiary that houses (“escrows”) servicer compensation and pays servicer expenses. Loan servicing assets would be self-funded eliminating the current capital cost for banks and the under capitalization by non-bank financial entities. In this example, the issuer/servicer MBSCoinS represents a 1.27% interest in the master MBSCoin.

The guarantor gets paid via MBSCoinG (meaning they get a single insurance premium for standing behind security losses and servicer obligations) and receives a private digital key to activate payment for loan losses and potentially the cost of providing a backup servicer. The guarantor is backed by the implicit and/or explicit guarantee of the United States government. MBSCoinG represents 3.04% of the master MBSCoin.

The guarantor/exchange provides the monetization of MBSCoin (MBSCoinI, MBSCoinS, and MBSCoinG) to U.S. dollars possibly via a centralized custodian. A private digital transaction key will allow the guarantor/custodian/exchange to validate primary and secondary market MBS transactions, servicing transactions, and guarantor transactions as a third-party signer or escrow agent.

The investor receives MBSCoinI security pools upon purchase. The principal and interest make up the pools (see previous table), so prepayments and monthly payments will result in somewhat different pricing.

Note: MBSCoinI could be traded in U.S. dollars, assuming the guarantor exchange provides the same pricing for MBSCoinS and MBSCoinG.

The investor/dealer will require a public digital transaction key for identification and complete transactions from issuer to investor/dealer (primary market) and investor/dealer to investor/dealer (secondary market). The investor/dealer makes a market in each of the monthly securities formed, as well as a when issued security of loans in the pooling/securitization process.

The diagram below summarizes responsibilities of and relationships between issuer/sellers, loan servicers, and guarantors using digital delivery.

Blockchain technology and cryptocurrency are revolutionizing many industries and can do the same for the mortgage market. The example of utilizing MBSChain and MBSCoin is one of many possible solutions that would provide up-front compensation for loan servicers and guarantors, who would be paid in MBSCoin the same as investors. In addition, all three participants would be paid in pro-rata principal and interest, reducing the interest-rate risk exposure of prepayments.

It also would create an MBSCoin exchange for transactions in U.S. dollars between participants and gives third-party verification.

MBSCoinS and MBSCoinG will have some limitations to ensure that the exchanges for U.S. dollars are only for paying expenses, loan losses or transfers.

NOTE: The servicer and guarantor “slots” can be filled by other operators/credit enhancers allowing a private-label solution to MBS execution and/or government agency backing.

Lastly, it solves the long-standing problem of comforting investors that transactions, loan servicing obligations, and industry guarantees are coordinated. Investors will recognize MBSChain as a holistic collateral and operations approach versus the piecemeal system utilized today.

Definitions:

Blockchain: A system in which a record of transactions made in bitcoin or another cryptocurrency is maintained across several computers that are linked in a peer-to-peer network

Cryptocurrency: A digital currency in which transactions are verified and records maintained by a decentralized system using cryptography, rather than by a centralized authority.

Genesis Block: The name of the first block of bitcoin ever mined, which forms the foundation of the entire bitcoin trading system.

Public crypto key: The cryptographic key that can be obtained by anyone to encrypt a message for a particular recipient, such that the encrypted messages can be deciphered only by using a second key that is known only to the recipient (the private key)

Private crypto key: A cryptographic key that can be used to unlock and lock the public key. The public key cannot derive the private key

Nick Krsnich is managing member of JMN Investment Management, a financial industry portfolio management and consulting firm. He was formerly the chief investment officer of Countrywide Financial Corp. and board member of Counrtywide Bank.

Photo: Hitesh Choudhary