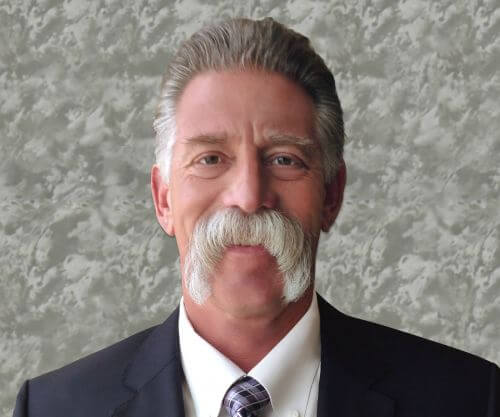

PERSON OF THE WEEK: Keith Guenther is CEO of USRES and RES.NET, offering real estate owned (REO) disposition, default valuations services and technology to the mortgage banking industry. MortgageOrb recently interviewed Guenther about the recent changes in the REO disposition industry, including how new regulations are reshaping asset management company operations and driving the need for new technology.

PERSON OF THE WEEK: Keith Guenther is CEO of USRES and RES.NET, offering real estate owned (REO) disposition, default valuations services and technology to the mortgage banking industry. MortgageOrb recently interviewed Guenther about the recent changes in the REO disposition industry, including how new regulations are reshaping asset management company operations and driving the need for new technology.

Q: USRES has been in the REO space for more than 23 years – what has that longevity taught you, and what advantages has it provided today?

Guenther: Our experience in REO allows us to provide our current clients with a set of best practices that has been acquired and fine-tuned over 23 years. In that time, we have continued to learn and adjust our strategy, enabling us to manage portfolios of varying sizes and types. Longevity in this industry is everything. It has allowed us to acquire a wide range of expertise on the various nuances of various states and local municipalities. This is the type of crucial knowledge that cannot be gained in just a few years or even by hiring key personnel.Â

Longevity has also taught us the value of being a true collaborative partner to our customers and other industry peers. Although service-level agreements are certainly important, we believe it is equally important to acknowledge that real estate is a living industry where rule changes and operational shifts are the norm. This perpetual movement calls for transparent partnerships between service providers and their clients. By maintaining a flexible environment, we are able to quickly adapt our practices in order to mitigate loss and provide our clients with the first-in-class service they deserve.

Q: What recent changes have you seen in the REO disposition industry?

Guenther: Along with the recent news of Fannie and Freddie selling off their nonperforming loans, we have also seen a rise in new servicers, as well as a greater variety of business models. This has changed the game for service providers, who are now pivoting in response to new players that might not yet have the infrastructure – or a pool of vetted third-party vendors, for instance – on hand to efficiently liquidate REO inventory on their own. When innovative servicers are united with well-established partners, new standards may arise, which then go on to reinvigorate the entire industry.

Q: As of late, there has been increased industry focus on compliance. How has that impacted your REO operation?

Guenther: In the REO business, compliance can refer to many things. It is used to signify requirements on multiple levels, including federal borrower protection, state and local ordinances, as well as individual investor benchmarks. These all boil down to continued increased scrutiny throughout the entire REO process. For our clients, this results in the need for additional tasks, benchmarks, timelines and systems of record – all of which are driven by the underlying need to increase transparency across the board.

There is a diverse range of tasks for which our clients have to adjust their processes to remain compliant, whether it is their deed-in-lieu, vacant building registration or price reductions process. Our clients are addressing many of these demands with technology that can better control these processes. They absolutely have to be nimble and capable of adjusting quickly – and as their service provider, so do we.

Q: What role does technology play in the equation?

Guenther: Even the most professional and experienced staff must rely on a technology platform to aid in the management of REOs. This is part of a larger, ongoing trend that places technology at the center of every business.

Our clients are now relying heavily on technology to increase both efficiency and transparency throughout every process. They need technology to drive everything from communication and tasking to reporting and data management; this ensures both accountability as well as optimal productivity. We feel that technology should be built with the future in mind. We rely on the RES.NET platform and are uniquely positioned to respond quickly to both industry trends and the specifications of our individual clients.

Q: What factors should servicers consider when choosing an asset management company?

Guenther: Servicers should look to asset management companies that focus on creating long-term partnerships and place a premium on customer service. For example, we ensure our clients have constant access to assistance from a stateside customer service team, account managers and staff. Servicers should also ensure an asset management company has a vetted vendor network and regularly updated vendor scorecards to ensure their entire network adheres to specified standards of excellence.

We welcome the entrance of new firms in the REO space; healthy competition will undoubtedly allow service providers that bring the most value to rise to the top. Throughout our 23 years in the industry, we've serviced a variety of client types through multiple real estate cycles. This experience allows our clients to do business with the confidence that their files are being handled securely and professionally.