PERSON OF THE WEEK: It’s well known that natural disasters can wreak havoc on mortgage servicing operations. And considering the increase in hurricanes, wildfires and floods during the past 10 years, servicers and lenders have reason to be concerned.

Today, servicers and lenders administrating loans in disaster-prone areas must have a strong response playbook in place to deal with the unthinkable – not only to prevent delinquencies and foreclosures and shield investors, but more importantly to assist borrowers who have, in many cases, had their lives completely turned upside down.

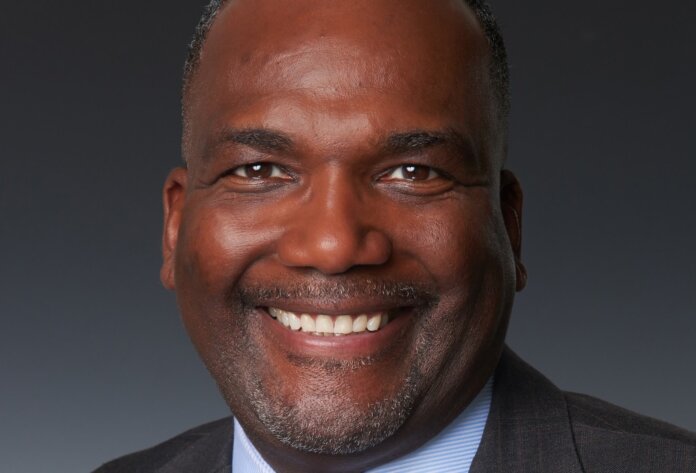

To learn more about how lenders and servicers should prepare for a future that will likely include an increase in natural disasters, MortgageOrb interviewed Ken Harrison, vice president, agency and industry relations at Gateway First Bank.

Q: Many regions of the U.S. have faced hurricanes, mass flooding and forest fires. How do natural disasters like these affect the housing market?

Harrison: Natural disasters impact the housing market in many different ways and can have lasting effects, especially for borrowers and their families. Our company has a sizable servicing portfolio, so it is critical that we pay close attention to how the disaster directly impacts our borrowers and their properties – and to what extent.

Natural disasters can also cause major disruption for those in the market, whether they are looking to buy a home or refinance. For a borrower in the process of doing either, a natural disaster can wreak havoc and damage the property, as well as the borrower’s ability to be employed.

Q: How does property loss as a result of natural disasters impact delinquency rates?

Harrison: When natural disasters strike, the borrower is understandably focused on their family and own well-being, as well as condition of their home, which in turn can impact their ability to stay engaged at work.

A disaster often puts borrowers in a predicament when they need to decide whether to spend their reserves on short-term repair expenses and essentials – or make their mortgage payment.

Additionally, employers may or may not have business disruption insurance. If they don’t, disasters may affect their ability to pay their employees, making it difficult for the borrower to make their mortgage payments.

Generally, this causes delinquency rates to rise. If you look at the more recent events, like Hurricane Dorian or the flooding in the Midwest, delinquencies increased.

Q: Should mortgage lenders have a contingency plan in place for natural disasters? If so, what should that look like?

Harrison: Absolutely. Whether they originate or service loans, it is critical that mortgage companies have a plan in place, allowing them to be proactive should a natural disaster occur. Our disaster response playbook brings together all department procedures across the firm. This high-level game plan clearly outlines what each department should do when dealing with a disaster.

A comprehensive plan should include steps to take before, during and after the natural disaster strikes. It is important for lenders to know how to best prepare, if there’s time, prior to the disaster.

During the disaster, communication is crucial. The plan should clearly outline the most effective ways to reach borrowers.

In the immediate aftermath, lenders must execute effective outreach plans that help identify borrower impacts. A lender’s disaster plan should include varying courses of action to take based on the severity of the situation.

Lenders and servicers should also have a plan in place to address the needs of their own employees. Much like the plan for borrowers, this plan should outline how to care for employees before, during and after a natural disaster.

During the recent flooding in Oklahoma, many of our team members were affected. Fortunately, we were prepared to respond to the needs of our colleagues and our surrounding communities.

Q: How can mortgage professionals best serve those affected by natural disasters?

Harrison: Lenders should strive to have productive relationships with their borrowers through the good and the bad. When natural disasters occur, lenders must first assess the impact and exposure to determine which borrowers are affected. From there, a lender can follow industry guidelines that dictate next steps

A primary concern is giving borrowers and their families relief. During a disaster, it is more important for borrowers take care of themselves, rather than worry about making their next mortgage payment.

To help, we offer forbearance plans, which give borrowers the ability to “press pause” on their payments until they’re back on their feet.

Home retention programs are another option to give borrowers more time to make their payments.

While many of these processes are industry standard, how well a lender executes them is ultimately most important. The industry guidelines should be implemented quickly and as seamlessly as possible.

Q: What responsibility do lenders have to their customers who are affected by natural disasters from a social responsibility standpoint?

Harrison: During the floods, we partnered with various nonprofits throughout the affected areas and raised $10,000 for the Disaster Relief Fund of Eastern Oklahoma. Our team members also donated their time, putting together food bags and helping where it was needed.

As important as monetary donations are, it is also crucial for organizations across all industries to put their boots on the ground and volunteer.

Q: What lessons should have lenders learned from the past natural disasters to help them prepare for the future?

Harrison: They must have a desire to learn from the past. Every natural disaster, while extremely unfortunate, gives organizations the ability to reflect on lessons learned. It is an opportunity to understand what one could have done better. It allows lenders to refine their playbook to ensure they are even more prepared next time.

We share our lessons learned with others, even our competitors. We also provide feedback to decision makers and governmental agencies.

In times of disaster, communication is critical, as everyone must work together to help the affected communities.