BLOG VIEW: The U.S. Treasury Department and the Federal Housing Finance Agency (FHFA) have jointly issued new guidelines on releasing Fannie Mae and Freddie Mac from government supervision, restoring Treasury’s authority to approve any release plan.

That means protracted comment periods and approval from the Financial Oversight Council.

The GSEs were “free standing” at one point. Will the same financial structure prior to conservatorship work?

If not, what needs to be changed and what third parties – other than the GSEs and the government backstop – will need to be involved?

Whatever structure is designed it must retain the current GSE bond financing, secondary market execution and government “implicit” guarantee.

This implicit guarantee, never truly defined but more market assumed, affords rating agency comfort, government agency status, and deep pocket security (and hopefully capital) investors.

The guarantee is considered “explicit.”

GSE capital and credit structure(s) prior to conservatorship is an advanced CFA topic. What follows is a streamlined version of the former structure focused on the coverage of losses, with a potential pool insurance/reinsurance overlay addressing the residential loan loss claims the market never expected that led to receivership.

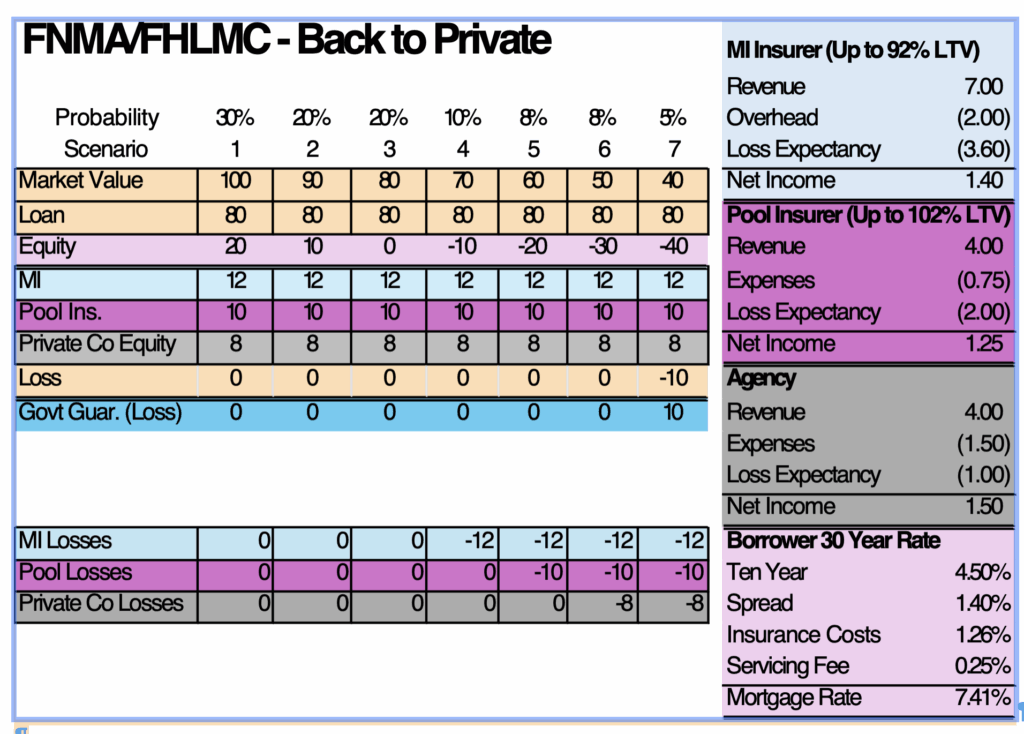

This simple model is a one-pool (with all identical loans) loss probability that is extrapolated into mortgage insurer, pool insurer, agency, and government loss expectancy and financials. Liberties have been taken with assumptions and calculations that would require extensive analysis. Examples include mixing loan-level and pool insurance math, life of loan income statements, and simultaneous losses and insurance premium collection.

Who are the players?

Borrower: Our mortgagor makes a 20% downpayment.

Private Mortgage Insurers (PMI): For borrowers who are unable to make a 20% home downpayment PMI protects lenders against losses due to default. The higher the loan-to-value ratio the higher the coverage required by the GSE’s. The PMI provides 12% coverage on a 30-year fixed rate loan with an 80% loan-to-value ratio. PMI is loan-level insurance.

Pool Insurer/Reinsurer (RI): In the past the Agencies have not had reinsurance like many insurance providers. Will the capital markets, both equity and debt, require a “pool” insurance layer to comfort investors? Who will the provider be? PMIs? A consortium of investors forming a reinsurer? What is known is that Great Recession residential defaults pierced both PMI coverage and GSE equity. Pool insurance adds a layer of capital in front of agency equity. In the chart below, we have assumed a 10% layer of pool coverage bringing the total of PMI and reinsurance coverage to 22%.

What level of capital should be required?

Pre-government takeover the estimated effective asset leverage of FNMA and FHLMC (confusing balance sheets) was almost 100 to 1.

Here, in the chart above, we have chosen 8% more in line with bank capital standards. The GSEs model does not change, the capital structure is replaced.

Conveniently ignored here are all the political process steps to bring the GSEs to market.

Bottom line: The strong “implicit” guarantee cannot be avoided. Without that backstop, insurance, capital markets, and investor participation will fail.

An advantage of this proposed model would be that an overextended federal government reduces its overall loss exposure to the mortgage market by adding third party credit enhancement providers.

However there could be cons: Based on today’s mortgage rates the borrower would pay .75% to 1% higher in interest costs. “Insurance Costs” in the borrower 30-Year rate calculation assumes estimated loss coverage necessitated by PMIs, RIs, and GSEs. Overtime, loss coverage will decline as corporate and credit structures are accepted and more participants enter the market. If the higher borrower costs are unacceptable, the federal government may initially need to participate in the RI and/or capital structure of the GSEs.

Also, the agencies have “subsidized” new and affordable housing products in concert with political or market initiatives. Does a quasi-government agency feel this same influence of Washington politics? Probably, but at a higher cost to the end borrower.

Politically charged GSE transition will prove challenging with many interested parties needed to compromise and agree on a complex corporate structure.

Nick Krsnich is managing member of JMN Investment Management, a financial industry portfolio management and consulting firm. He was formerly the chief investment officer of Countrywide Financial Corp. and board member of Counrtywide Bank.