BLOG VIEW: What factors really drive the lending market?

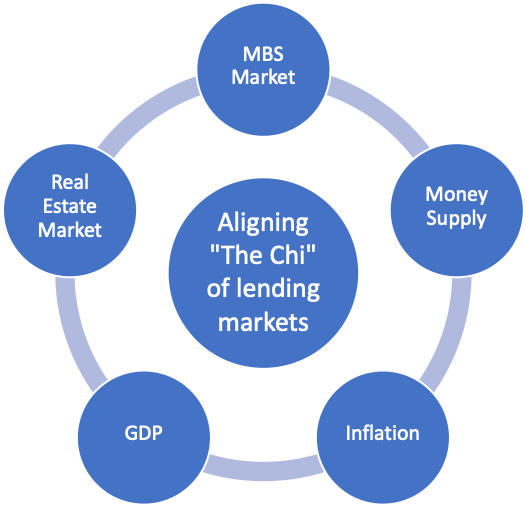

As shown in the graphic below, the main ones are the MBS market, the real estate market, GDP, inflation, and money supply.

It is the delicate balance of these factors that keeps the housing market “chi,” or “vital life force,” flowing. From real estate sales, home financing, servicing, thru to capital markets, the real estate finance ecosystem relies heavily on each of these factors to actively work in harmony – and if anything becomes misaligned, we experience a disturbance in the force.

MBS Market

As anyone who has seen the movie “The Big Short” will recognize, when Lewis Ranieri conceptualized “mortgage backed securities,” the industry gained the liquidity that would drive exponential growth. As a result, we are critically dependent on this liquidity for the ongoing replenishment of the demand that drives real estate financing.

Money Supply

Increasing the availability of funding for real estate financing impacts the availability of credit for borrowing. The Fed’s increasing or decreasing of the fed funds rate has an impact that will stimulate or constrain lending as has been happening this year.

Inflation

Increasing prices on all goods reduces consumer purchasing power and creates an upward pressure on lending rates causing a cooling impact on housing markets. Everything cost more and consumers can no longer afford homes, they want.

GDP

Housing is between 16% to 18% of GDP, economic growth has an impact on housing markets and is a key part of the delicate balance we need to maintain. A slowing economy with higher unemployment reduces borrowers’ ability to purchase homes. Correspondingly, too much growth, although good for the economy helps increase the housing demand causing upward pressure on prices.

Real Estate Market

Demand within the housing market, and socioeconomic (unemployment) conditions can have a dramatic impact on the actual housing market. For example, during the pandemic initially the demand for housing dropped; however, over time we saw an increase demand in investment purchases. And as the option to work from home continued to grow, a shift to increased purchase transactions in lower-cost higher-value homes occurred; for example, the shift to Texas.

For the real estate and housing finance markets to work effectively all these factors must be in alignment and working harmoniously. There isn’t a right or wrong, the goal is not to have zero inflation, exponential GDP growth or leave fed funds at zero.

What we need is a balance among all of these factors to ensure that the lending market remains stable and continues to grow. Extreme states of these variables could have adverse impacts on the real estate and housing finance markets.

Our main goal from the point of view of the primary market, secondary market, capital markets and regulators is to ensure these factors are balanced and make adjustments to help regain alignment.

So, although the interest rates hike over the past year have been painful to all parties involved, rest assured, the rates are leading to a realignment and growth in the future.

The key question is when…when will we regain balance in the force?

Sundeep B. Mathur is vice president of fintech practice for TAVANT.