PERSON OF THE WEEK: One of the main responsibilities of any mortgage servicer is resolving borrower complaints.

Note that the term used is “resolving” – as opposed to “handling.” A mortgage servicer should be able to do much more than just receive complaints and categorize them. It must be able to determine if a complaint is part of a pattern. And if it is part of a pattern, the root cause of that complaint needs to be identified and addressed.

Mortgage servicers concerned with borrower retention and loyalty almost never view themselves as complaint “repositories;” they are always looking for new ways to resolve complaints and keep them from repeating.

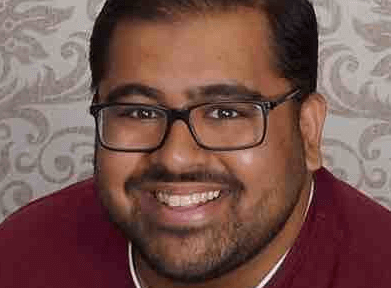

But how can a busy servicing shop carry out this complex task quickly, accurately and in fully compliant fashion? To find out, MortgageOrb recently interviewed Zaid Shariff, vice president, head of solution design and product implementation, for mortgage servicer SLK Global Solutions.

Q: Is there anything else besides resolving a complaint that a servicer should be doing?

Shariff: Customer complaints provide insight into what needs to be fixed. If there is a sudden rash of complaints about a specific issue, a system should be in place to identify the issue and what internal process is causing it, then correct the process before it becomes a bigger problem. Servicers need to get to a point where they find issues and fix them as they occur.

Q: Does that mean that mortgage servicers should be hiring more compliance workers?

Shariff: Not necessarily. In fact, many servicers might have too many people on their payrolls for resolving customer disputes. The truth is that technology solutions can automate virtually the entire complaint resolution process, so a servicer’s staff can focus on ensuring individual consumers get the help they need.

With the technology that is available today, servicers can be alerted to complaints and identify and analyze complaint trends to avoid the same situations going forward. By investing in the right technology, they can significantly reduce the issues that can lead to complaints.

Q: How has technology adoption been with the complaint resolution process?

Shariff: The mortgage market has been too slow about technology adoption in general. New FinTech and RegTech solutions are doing a lot of great things, but servicers need to think of compliance tools such as complaint resolution technology as investments and not sunk costs. It has to make sense from an ROI perspective.

Q: How can the adoption rate be improved?

Shariff: Technology providers need to do a better job making adoption easier and be able to demonstrate the ROI on their technology. However, the most important thing is getting servicers to look at compliance costs in a different way. Most servicers view compliance as a cost of doing business. They need to flip this idea on its head and say, “No, this is really an opportunity for us to do a better job in the market.” They should be looking to convert it into an opportunity and a thing that they must do.

Q: What is the ROI on compliance technology investments?

Shariff: Any solid technology investment creates increased efficiency and reduced risk. Servicers need to take into consideration what they are currently paying in staff costs to maintain compliance and resolve complaints. They also have to consider future costs, too, considering the number of borrowers in distress is likely to grow. Then they can simply weigh these costs against the technology investment and see if it makes sense.

It’s important to ask any technology provider to demonstrate the ROI behind its solutions. For example, we have clients that have been able to lower their complaint resolution costs by as much as 60 percent simply by automating manual processes through our Copasys solution.

Q: Are there any other economic benefits to investments in compliance technology?

Shariff: Sure. Customer satisfaction is huge in the mortgage industry. If a servicer has good compliance technology and is automating complaint resolutions, then it will have happier customers who are more likely to refer their friends and family to the origination business.

At the end of the day, a servicer’s job is to assist customers and retain their business by keeping them happy. Any technology that helps a servicer accomplish these things better and more efficiently is going to pay off.