BLOG VIEW: Back in February, Elizabeth Warren took center stage in her first hearing as a U.S. senator by berating federal regulators for not doing enough to go after the so-called ‘too-big-to-fail’ financial institutions.

BLOG VIEW: Back in February, Elizabeth Warren took center stage in her first hearing as a U.S. senator by berating federal regulators for not doing enough to go after the so-called ‘too-big-to-fail’ financial institutions.

‘I want to note that there are district attorneys and U.S. attorneys who are out there every day squeezing ordinary citizens on sometimes very thin grounds and taking them to trial to 'make an example,' as they put it,’ Warren snapped at the regulators who were testifying before the Senate Banking Committee. ‘I am really concerned that too-big-to-fail has become too-big-for-trial.’

Well, Warren wasn't that concerned – despite a flurry of media activity about her tough talk, the Massachusetts Democrat ultimately had nothing to offer but tough talk on the subject. However, another New England senator was not shy about standing up for his principles by seeking to tear down those mega-banks.

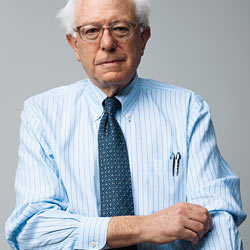

Last week, Sen. Bernie Sander, I-Vt., reintroduced the ‘Too Big to Fail, Too Big to Exist Act’; Rep. Brad Sherman, D-Calif., offered the same bill in the House of Representatives. If passed, this legislation would require the Secretary of the Treasury to identify and break up institutions that are deemed too big to fail to avoid the potential for a future government bailout.

Unlike Warren, who has conveniently avoided commenting on the Obama administration's refusal to pursue criminal prosecution against any Wall Street executive at the heart of the 2008 crash, Sanders has made it clear that U.S. Attorney General Eric Holder was being ridiculous when he claimed his department would not pursue this type of prosecution because it could ‘have a negative impact on the national economy, perhaps even the world economy.’

‘We have a situation now where Wall Street banks are not only too big to fail, they are too big to jail,’ Sanders said. ‘That is unacceptable, and that has got to change because America is based on a system of law and justice.’

I somehow suspect there would be an extraordinary hue and cry if the Sanders-Sherman bill managed to snake its way from colorful proposal to historic floor vote. And it would not just be a protest from the banks: The Obama administration has made it very clear that it will not upset the Wall Street fat cats, while the Democratic leadership is also eager to maintain the status quo. Lest we forget, Sanders tried to get a similar proposal into the Dodd-Frank Act, but his efforts were swatted away by the legislation's authors and not appreciated by the Oval Office.

I don't share a great deal of ideological common ground with Sanders – after all, he self-identifies as a ‘democratic socialist’ and regular readers of this blog may have noticed that I tend to swing a bit to the right. And I can't say that I'm entirely supportive of this new bill. But I love Sanders' visceral approach to politics and his willingness to stand up firmly for what he believes in. Remember, he was the senator who openly groused that none of the gift shops at the Smithsonian Institution contained a single product that was manufactured in the U.S.

And despite his advocacy of left-wing politics, Sanders is not shy about calling out phonies on his side of the aisle – even the ones that live at the far end of Pennsylvania Avenue, as witnessed by his stunning observation in the ongoing debate over the fate of Social Security.

‘In 2008, candidate Barack Obama told the American people that he would not cut Social Security,’ he said. ‘Having him go back on his word will only add to the rampant political cynicism that our country is experiencing today.’

Clearly, Sanders' reintroduced legislation will not get very much traction on Capitol Hill. And even though I don't agree with many of his views, I admire his passion and determination. After all, that kind of spirit is what separates the leaders from the poseurs – which is a lesson that Sanders' colleague from Massachusetts has yet to comprehend.

– Phil Hall, editor, MortgageOrb

(Please address all comments regarding this opinion column to hallp@mortgageorb.com.)