Fannie Mae’s Home Purchase Sentiment Index (HPSI) decreased 0.8 points to 74.7 in November, as consumers expressed not only disparate views of home-buying and home-selling conditions but also their greatest economic pessimism in 10 years.

Overall, four of the index’s six components decreased month over month. In November, 74% of respondents reported that it’s a good time to sell a home, compared to the 29% of consumers who reported that it’s a good time to buy.

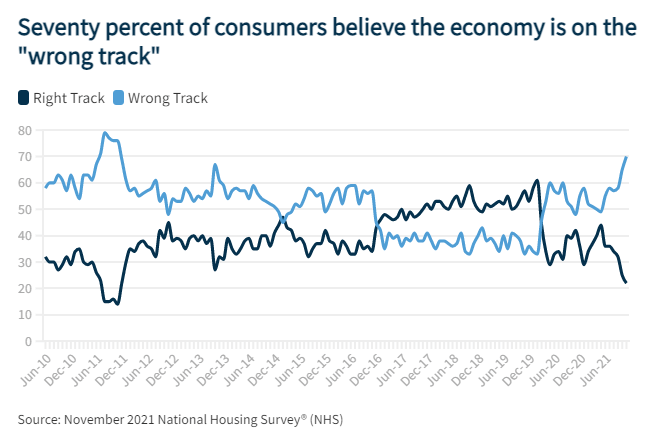

Consumers also continued to report strong expectations that mortgage rates will increase over the next 12 months, and they expressed even greater pessimism about the direction of the economy, with 70% saying it’s on the wrong track.

Year over year, the full index is down 5.3 points.

“The HPSI experienced some shuffling among its underlying components in November, but the overall index once again stayed relatively flat,” says Mark Palim, Fannie Mae’s vice president and deputy chief economist. “While consumers expressed even greater concern regarding the direction of the economy, with the share of respondents expressing pessimism hitting a 10-year high, overall housing sentiment remained stable. Consumers’ concerns for their personal job situation have eased and respondents also reported feeling better about their income level compared to a year ago, with both of those components now nearing their pre-COVID levels.

“Even though consumers are reporting broader macroeconomic concerns – with much of it likely tied to inflation – so far any negative sentiment tied to the economy has not translated into a meaningful decrease in actual purchase mortgage demand,” continues Palim. “According to this month’s survey, an even greater share of consumers (particularly those with low and moderate incomes) expects mortgage rates to go up in the next 12 months, which may be a signal that some households plan to pull-forward their home purchase plans despite growing economic apprehension.”

The percentage of respondents who say:

- it is a good time to buy a home decreased from 30% to 29%, while the percentage who say it is a bad time to buy decreased from 65% to 64%. As a result, the net share of those who say it is a good time to buy remained unchanged month over month.

- it is a good time to sell a home decreased from 77% to 74%, while the percentage who say it’s a bad time to sell increased from 17% to 21%.

- home prices will go up in the next 12 months increased from 39% to 45%, while the percentage who say home prices will go down decreased from 22% to 21%. The share who think home prices will stay the same decreased from 32% to 28%.

- mortgage rates will go down in the next 12 months remained unchanged at 5%, while the percentage who expect mortgage rates to go up increased from 55% to 58%. The share who think mortgage rates will stay the same decreased from 33% to 32%.

- they are not concerned about losing their job in the next 12 months decreased from 84% to 83%, while the percentage who say they are concerned remained unchanged at 15%.

- their household income is significantly higher than it was 12 months ago remained unchanged at 23%, while the percentage who say their household income is significantly lower increased from 12% to 13%.