BLOG VIEW: As we move into 2013, we will be saying goodbye to a trio of Washington-based figures who were at the heart of the changing relationship between Washington and the financial world. For better or worse, these individuals made a significant impact on housing finance – and, if anything, Washington will be a lot less interesting without them.

BLOG VIEW: As we move into 2013, we will be saying goodbye to a trio of Washington-based figures who were at the heart of the changing relationship between Washington and the financial world. For better or worse, these individuals made a significant impact on housing finance – and, if anything, Washington will be a lot less interesting without them.

The first member of the trio who is on the way out of Washington is Rep. Barney Frank, D-Mass. As the co-author of the 2,300-page legislation that forever changed how the financial services world operates, Frank has cultivated an equal number of admirers and critics – and many of Frank's detractors will point out that he has also been responsible for rewriting a great deal of his own history regarding his role in politicizing the federal housing finance environment in a manner that enabled the disastrous rise of the housing bubble.

Indeed, Frank's critics have a point. Last year, when a writer from New York magazine inquired about his 2003 comments that Fannie Mae and Freddie Mac were ‘not facing any kind of financial crisis,’ Frank acknowledged he was wrong, but quickly blamed his Republican counterparts for the chaos.

‘This is the most intellectually dishonest argument from Republicans,’ he said. ‘Remember, I was in the minority from 1995 to 2006. They were in charge. Their argument appears to be that I stopped [House Speaker] Tom Delay from doing something. But this is all on their watch.’

The Dodd-Frank Act did not include any mention of government-sponsored enterprise reform – Frank and his Democratic colleagues in Congress successfully kept that out of the legislation. However, he also refused to accept any responsibility for a failure to enact bipartisan agreement on housing finance issues, and he attempted to distract attention away from his record by citing a polarizing Tea Party favorite as the foe of congressional cordiality.

‘People ask me, 'Why don't you guys get together?'’ Frank said in his New York Magazine interview. ‘And I say, 'Exactly how much would you expect me to cooperate with Michele Bachmann?' And they say, 'Are you saying they're all Michele Bachmann?' And my answer is no, they're not all Michele Bachmann. Half of them are Michele Bachmann. The other half are afraid of losing a primary to Michele Bachmann. So, no, there are maybe three Republicans I can work with, on a couple of issues, out of the thirty-something on the committee.’

However, we may not have seen the last of him. Last week, Frank made a surprising public plea to serve as Massachusetts' interim senator if John Kerry leaves Capitol Hill for the State Department. Stay tuned to MortgageOrb for more updates.

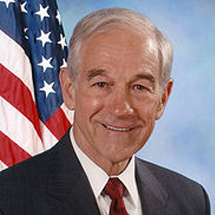

Also retiring this month is Rep. Ron Paul, R-Texas. Unlike Frank, Paul's legacy is primarily based on ideas rather than legislative achievements. As the most prominent member of the libertarian fringe of the Republican party, Paul has frequently been out of step with the GOP's conservative majority. And, quite frankly, you can't blame the conservatives: Paul's advocacy of such unlikely and excessive causes as restoring the gold standard and shutting down the U.S. Department of Housing and Urban Development – along with the departments of Energy, Commerce, the Interior and Education – is, admittedly, a bit too much.

Nonetheless, Paul received a vindication of sorts during the 112th Congress, when he was appointed chairman of the House Subcommittee on Domestic Monetary Policy and Technology and introduced legislation to one of his long-time pet projects: auditing the Federal Reserve. But whereas Paul's previous attempts to bring about this legislation were dismissed by most of his colleagues, this time he hit pay dirt: The bill was supported by a bipartisan coalition of more than 220 Democratic and Republican members of the House of Representatives and passed his committee in a voice vote.

Unfortunately, the partisan divide in Congress effectively stalled the bill's journey to the Senate. Nonetheless, Paul's efforts sent a very clear message that will be picked by future congressional leaders of both parties: the Fed is not above the law, and it should be answerable to the public that finances its operations.

The third man on the way out of Washington is Raj Date, the deputy director of the Consumer Financial Protection Bureau (CFPB). In many ways, Date's departure is the most bittersweet of the three, since his relatively brief presence in Washington represented the ultimate lost opportunity.

Date was a former Wall Street Executive who was recruited to the CFPB as associate director of research, markets and regulations. For a brief period in 2011, his name was floated by the White House as a possible CFPB director after it became clear that Elizabeth Warren would not receive Senate confirmation. If Date was named, it would have sent the signal that the Obama administration would not use the CFPB for pushing a political agenda, and the results could have been a new degree of cooperation between Washington and the private sector in guaranteeing consumer protections without burdening financial services companies under onerous regulations.

That did not happen, though it was hardly Date's fault. He remained at the CFPB and served as its unofficial leader until Richard Cordray assumed the directorship on Jan. 4 via a controversial presidential recess appointment. During that period when he was running the agency, Date attempted to build bridges to the financial services industry and to assure lenders and servicers that the CFPB was eager to build a positive working relationship with the private sector. Indeed, his speech before the 2011 Mortgage Bankers Association's annual convention offered the ultimate rarity: a bureaucrat who spoke the language of private enterprise and understood the needs of the private sector.

Date was appointed CFPB deputy director by Cordray on Jan. 5, 2012 and served throughout last year without controversy. It is unclear why he is leaving now, with so much of the agency's work in the process of being finalized. The CFPB will not be a stronger agency with his absence and – unlike the retirements of Frank and Paul – Date's departure will only leave a greater uncertainty on what progress, if any, will result this year.

– Phil Hall, editor, MortgageOrb

(Please address all comments regarding this opinion column to hallp@mortgageorb.com.)