ATTOM’s Q2 2021 U.S. Home Sales Report shows that profit margins for home sellers took an unusual dip in the second quarter but still were far above where were they were a year earlier.

In a sign that the housing market remained super-heated but that investment returns may be declining, the report reveals that the typical single-family home and condo sale across the U.S. during the second quarter of 2021 generated a profit of $94,500. That was up from $90,000 in the first quarter of 2021 and from $60,572 in the second quarter of 2020.

However, the profit margin on the median-priced house or condominium declined from 48.4 percent in the first quarter of this year to 44.9 percent in the second quarter. While the latest margin remained 13 points above the 32 percent level recorded a year earlier, the drop-off marked a rare decline during a time of year that usually produces some of the best returns for sellers. The last time typical returns on investment dropped nationally during any second-quarter period was in 2008.

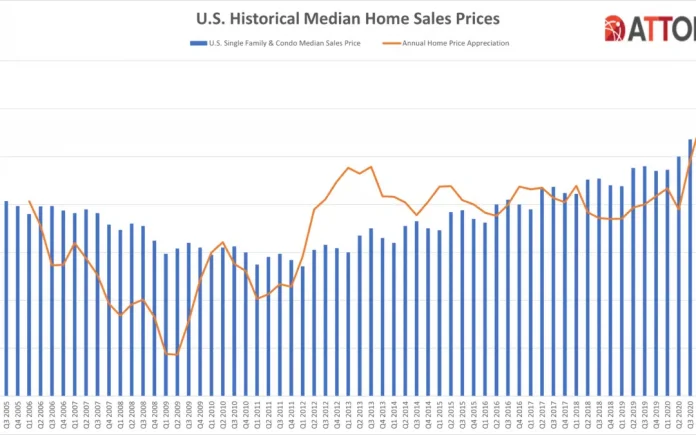

The mixed picture of high, but reduced, profit margins came as the national median home price hit yet another record in the second quarter of 2021, reaching $305,000. That was up 11 percent from $275,200 in the first quarter of 2021 and 22 percent from $250,000 in the second quarter of 2020. The annual price surge marked the largest since at least 2006 and was two to four times greater than increases seen just a year ago.

Still, profits dropped in the second quarter of this year because price gains—high as they were—were smaller than increases that recent sellers had been paying when they originally bought their homes. The gap between the latest price gains and earlier increases caused the dip in profit margins.

While home prices rose from the first to the second quarter of 2021 in 98 percent of U.S. metropolitan areas with enough data to analyze, investment returns rose in only 56 percent.

Typical profit margins rose from the second quarter of 2020 to the second quarter of 2021 in 158 (81 percent) of 195 metro areas around the United States with sufficient data to analyze. But margins increased from the first to the second quarter of 2021 in just 109 (56 percent). Metro areas were included if they had at least 1,000 single-family home sales in the second quarter of 2021 and a population of at least 200,000.

Homeowners who sold in the second quarter of 2021 had owned their homes an average of 6.3 years, down from 7.21 years in the first quarter of 2021 and from 7.61 years in the second quarter of 2020. The latest average tenure figure marked the shortest time between purchase and resale since the first quarter of 2013.

Nationwide, buyers using Federal Housing Administration (FHA) loans accounted for only 7.9 percent of all single-family home purchases in the second quarter of 2021, the lowest level since the fourth quarter of 2007. The latest figure was down from 9.1 percent in the previous quarter and from 12.9 percent a year earlier.

Read the full ATTOM U.S. Home Sales Report here.