WORD ON THE STREET: The multiyear boom and bust in housing prices of the past decade, together with the sharp increase in mortgage delinquencies and defaults that followed, were among the principal causes of the financial crisis and the ensuing deep recession – a recession that cost some 8 million jobs. And continued weakness in housing – reflected in falling prices, low rates of new construction and historic levels of foreclosure – has proved a powerful headwind to recovery.

WORD ON THE STREET: The multiyear boom and bust in housing prices of the past decade, together with the sharp increase in mortgage delinquencies and defaults that followed, were among the principal causes of the financial crisis and the ensuing deep recession – a recession that cost some 8 million jobs. And continued weakness in housing – reflected in falling prices, low rates of new construction and historic levels of foreclosure – has proved a powerful headwind to recovery.

It is encouraging, therefore, that we are seeing signs of improvement in the housing market in most parts of the country. House prices nationally have increased for nine consecutive months, residential investment has risen about 15% from its low point, and sales of both new and existing homes have edged up. Home builder sentiment has improved considerably over the past year, and real estate agents report a substantial rise in home buyer traffic.

The growing demand for homes has been underpinned by record levels of affordability, the result of historically low mortgage rates and house prices that are 30% or more below their peaks in many areas. To be sure, the housing sector is far from being out of the woods. Construction activity, sales and prices remain much lower than they were before the crisis, and about 20% of mortgage borrowers remain underwater.

Despite marked improvements in overall credit quality, 7% of mortgages are either more than 90 days overdue or in the process of foreclosure. And, although the number of homes in foreclosure has edged down since cresting in 2010, that number remains in excess of 2 million, three times the historical norm.

Meanwhile, the national homeownership rate has slipped nearly four percentage points from its 2004 high of 69%, and it now stands at a 15-year low. So, although there are good reasons to be encouraged by the recent direction of the housing market, we should not be satisfied with the progress we have seen so far.

Lower-income and minority communities are often disproportionately affected by problems in the national economy, and the effects of the housing bust have followed that unfortunate pattern. Indeed, as a result of the crisis, most or all of the hard-won gains in homeownership made by low-income and minority communities in the past 15 years or so have been reversed. For example, among all income groups, between 2007 and 2010, homeownership rates fell the most for households with income of $20,000 or less, according to the Federal Reserve's Survey of Consumer Finances. Data from the Census Bureau show that, over the period from 2004 to 2012, the homeownership rate fell about five percentage points for African Americans, compared with about 2 percentage points for other groups.

Homeownership rates fall when existing homeowners lose or leave their properties, when barriers to homeownership increase, or both. In recent years, both factors have been important. Home loss through foreclosure, though down from its peaks, remains an important problem, with lower-income and minority homeowners often being the hardest hit. Importantly, foreclosures can inflict economic damage beyond the personal suffering and dislocation that accompany them.

Foreclosed properties that sit vacant for months or years often deteriorate from neglect, adversely affecting not only the value of the individual property, but the values of nearby homes as well. Concentrations of foreclosures have been shown to do serious damage to neighborhoods and communities, reducing tax bases and leading to increased vandalism and crime. Thus, the overall effect of the foreclosure wave, especially when concentrated in lower-income and minority areas, is broader than its effects on individual homeowners.

A strengthening housing market will help to gradually undo that damage, but the process has only begun.

Financial preparedness

One lesson of the past few years is that the desire to own a home is not enough. Although many foreclosures resulted from job loss or other economic hardships, others occurred because people bought more of a house than they could afford, took out a loan that was not appropriate to their circumstances or did not manage their resources well.

Future homeownership must be built on a more solid foundation. And while much of the responsibility for building that foundation must lie with lenders and with regulators, consumers must do their part as well by acquiring the information and financial knowledge they need to make sound decisions.

Effective financial education – aimed at both youths and adults – can provide people with the knowledge they need. Some of the skills that prospective homeowners need are relatively basic.

For example, knowing how to shop for the lowest interest rate and fees, understanding the difference between a fixed-rate and an adjustable-rate mortgage and, very importantly, knowing how to find trustworthy information and advice. More generally, the decision to buy a home must be consistent with a family's longer-term objectives, needs and resources.

Good financial planning – including effective budgeting, adequate saving and sensible investing – can help families maintain homeownership while also pursuing other important objectives, such as preparing for retirement or financial emergencies. And financially informed households will have a better chance to build wealth, reducing – in the case of minority households – the large wealth gap that exists between minorities and other groups.

At the Federal Reserve, we appreciate the benefits to families of acquiring basic information and skills about managing their money. But we see another important advantage of financial education, which is that an economy with financially knowledgeable households is likely to be stronger, more equal and more stable. As such, we all gain from efforts to increase financial literacy.

Although basic knowledge about money management and decision-making is extremely useful, it is not practical, of course, for everyone to be a financial expert. Sometimes a professional can help, and people should not be afraid to seek advice at appropriate times.

For example, an individual may be involved in buying a home – a complex and intimidating experience for many people – only once or twice in a lifetime. That's why advice from a housing counselor at the right point in the process can make all the difference.

Nonprofit organizations can help prospective homeowners assess their readiness to purchase. And, by providing useful information about how to search for a home, apply for financing, handle home maintenance and prevent delinquency, these nonprofits can help aspiring home buyers find the right home and maintain their mortgage payments.

We have also seen that counseling can help consumers who are facing delinquency or default. Borrowers in trouble who receive foreclosure counseling are relatively more likely to subsequently become current on their mortgage, receive a loan modification and, ultimately, keep their home.

Looking forward

Financial preparedness is important not only for prospective home buyers. It ought to be a lifelong undertaking, starting with children and teenagers. Organizations around the country help people across a range of ages develop their skills. Despite, or perhaps because of, the broader economic challenges we face, it now seems to be a time of creativity and innovation in this field. We are seeing experimentation, knowledge sharing, public-private collaborations, ‘bottom up’ community-driven approaches and state- and local-government efforts to promote family financial security and opportunity.

Unfortunately, just as families have been hurt by the financial crisis and recession, so have many community-based organizations. These groups face the daunting task of finding new sources of capital and investment in a constrained financial environment.

Some organizations have begun to retool their operations and develop new markets, products and strategies to better serve the financial needs of consumers and communities. Among other goals, they are developing strategies to foster responsible homeownership, which they see as an important building block for stronger communities.

To return to where I began: after a long and difficult period, we are seeing welcome signs of improvement in the housing market. An improving housing market will, in turn, aid the economic recovery while strengthening neighborhoods and increasing the financial well-being of families. Our recovery must be broadly felt to be complete, and families and communities that were already struggling before the crisis must be included in that recovery.

As Dr. Martin Luther King Jr. is widely quoted to have said, ‘We may have all come on different ships, but we're in the same boat now.’ The Federal Reserve will continue to do what we can to support the housing recovery, both through our monetary policy and our regulatory and supervisory actions.

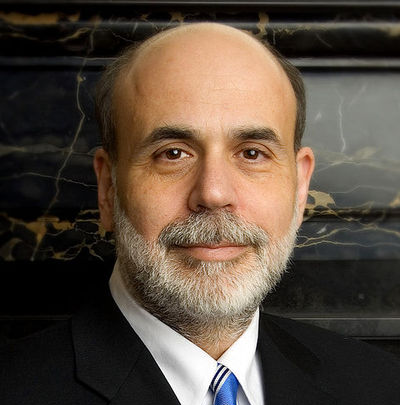

Ben Bernanke is chairman of the Federal Reserve System. This article is adapted and edited from a speech delivered before the Operation HOPE Global Financial Dignity Summit in Atlanta. The original text is available online.