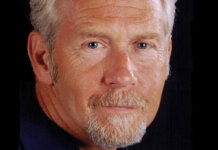

MQMR Hires Jeff Christensen as VP of Sales

Jeff Christensen recently joined mortgage compliance consultancy Mortgage Quality Management and Research (MQMR) as vice president of sales.

Christensen has more than 10 years of...

CFPB Settles with BSI Financial Services Over RESPA, TILA Violations

Mortgage servicer BSI Financial Services will pay a penalty of $200,000 and restitution to borrowers of at least $36,500 to settle allegations from the...

Multiple Staff Appointments at the FHFA

Christopher L. Bosland has joined the Federal Housing Finance Agency (FHFA) as senior advisor for regulatory affairs while Meghan C. Patenaude has joined as...

CFPB Gearing Up to Further Relax HMDA and Possibly Other Rules

The Consumer Financial Protection Bureau (CFPB) plans to further relax its Home Mortgage Disclosure Act (HMDA) rules and may be making additional rule changes...

ComplianceAnalyzer Now Integrated with LendingPad

ComplianceEase, a provider of mortgage compliance software, recently announced that its ComplianceAnalyzer solution is now integrated with with LendingPad, a cloud-based loan origination system...

FHA Proposing Significant Changes to its Lender Certification Requirements

The Federal Housing Administration (FHA) is proposing several revisions to its lender certification requirements with the goal of providing lenders and servicers greater certainty...

MetaSource Report Reveals Weak Points in Servicers’ MERS Compliance

Mortgage servicers are sometimes failing to adequately document the reasons behind a decision to move forward with a default for bankruptcy or foreclosure, the...

Trump Directs Treasury, HUD to Enact Housing Finance Reform

President Trump has signed a presidential memorandum directing the Treasury Department and U.S. Department of Housing and Urban Development, along with other government agencies...

LoanLogics and VirPack Aim to Speed Loan Document Recognition and QC

LoanLogics, offering loan quality technology for mortgage manufacturing and loan acquisition, is now integrated with VirPack, a provider of virtual document management and file...

ComplianceEase Hires One, Promotes Another on its Executive Team

Sheila Meagher has joined ComplianceEase, a provider of automated compliance solutions, as senior vice president of sales and client success.

In addition, Dan Smith -...

ComplianceEase Taps Michael Jackman as CEO

Michael Jackman is the new CEO of ComplianceEase, provider of automated compliance solutions, replacing Anita Kwan, co-founder and CEO, who is retiring.

In addition, John...

Wipro Teams With ComplianceEase to Offer Per-Closed-Loan Pricing

ComplianceEase, a provider of automated compliance solutions to the financial services industry, has expanded its partnership with Wipro Gallagher Solutions (WGS), a Wipro Limited...

HomeStreet Bank Seeks to (Mostly) Exit the Mortgage Business

Citing that “it is still unclear when, and to what extent, industry conditions will improve," as well as an overly burdensome regulatory environment, HomeStreet...

OIG Report Finds that Former FHFA Director Watt Acted Inappropriately

An investigation by the Office of the Inspector General (OIG) for the Federal Housing Finance Agency (FHFA) into allegations of sexual harassment against former...

Mortgage Lending Outlook: What’s in Store for 2019

As the U.S. economy continued to strengthen throughout 2018, mortgage companies increasingly faced challenges related to rising interest rates, a shrinking housing inventory and...

Trump Administration Pushing for GSE Reform

Housing finance reform may soon be back on the table in Congress, as Senate Banking Committee Chairman Mike Crapo (R-Idaho) on Friday released a rough...

Denis Brosnan: Disaster Relief Strategies for Mortgage Servicers

PERSON OF THE WEEK: The hurricanes and wildfires of 2018 are stark reminders that U.S. residential properties are at increasing risk of natural disasters...

Opus Capital Markets Consultants Now Using ComplianceEase

Mortgage due diligence firm Opus Capital Markets Consultants is now using ComplianceEase to perform real-time, loan-level audits on loan pools that it reviews for...

LBA Ware’s CompenSafe Integrated with SimpleNexus

LBA Ware, a provider of automated compensation and sales performance management software for mortgage lenders, has completed a partial integration of its compensation platform, CompenSafe, with SimpleNexus’s enterprise digital mortgage solution.

As...

Vendorly Teams with Shared Assessments to License SIG Questionnaire

Vendorly, which offers a vendor oversight platform, is collaborating with Shared Assessments, a trusted source in third-party risk management, to license the Standardized Information...